What is A Dscr Loan? ; A Debt Service Coverage Ratio (DSCR) loan is a type of financial instrument offered by banks and other lending institutions. It is used to assess a borrower’s ability to repay a loan by evaluating their cash flow relative to their debt obligations. In essence, DSCR loans require the borrower to maintain a certain level of financial performance to remain in compliance with the loan terms. This description will provide a comprehensive overview of DSCR loans, including their purpose, calculation, significance, and impact on the lending and borrowing landscape.

What is A Dscr Loan? : Purpose of DSCR Loan

The primary purpose of DSCR loan is to ensure that borrowers have adequate cash flow to service their debt obligations. By evaluating a borrower’s financial health through the DSCR, lenders can determine the credit risk associated with extending a loan. This helps them make informed decisions about whether to approve or reject a loan application, as well as setting appropriate interest rates and loan terms.

How Does a DSCR Loan Work?

Unlike traditional loans, which are typically based on collateral, credit score, and other factors, a DSCR loan is based on the borrower’s cash flow. The lender calculates the borrower’s DSCR ratio by dividing their net operating income by their total debt service. Net operating income is the difference between a company’s revenue and expenses, while total debt service includes all outstanding debts and loan payments.

If a company has a Dscr ratio of less than one, it means they are not generating enough cash flow to cover their debt service obligations. In this case, the lender may reject the application or require additional collateral or personal guarantees. A DSCR ratio of one or greater indicates that the company is generating enough cash flow to cover their debt service obligations, making them more likely to be approved for the loan.

What is A Dscr Loan? : Advantages of DSCR Loans

One of the main advantages of a DSCR Loan is that it provides funding based on a company’s cash flow, rather than assets or credit score. This can make it easier for small businesses, startups, and other companies that may not have significant assets or a long credit history to qualify for financing. Additionally, DSCR loans often have lower interest rates and longer repayment terms than other types of business loans, allowing companies to manage their finances more easily.

What is Dscr Loan? : Disadvantages of DSCR Loans

While DSCR loans have many advantages, there are also some disadvantages that borrowers should be aware of. One potential disadvantage is that they can be more difficult to obtain than traditional loans, as lenders may be more cautious about providing financing based on cash flow alone. Additionally, Dscr loans may require more documentation and financial reporting than other types of loans, which can be time-consuming and costly for some businesses.

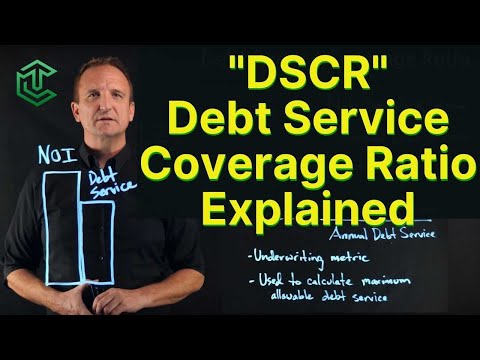

What is A Dscr Loan? : Calculation of Debt Service Coverage Ratio

The Debt Service Coverage Ratio is calculated as follows:

DSCR = Net Operating Income (NOI) / Total Debt Service

Net Operating Income (NOI): This figure represents the income generated from a borrower’s business operations or investment properties, excluding any financing costs or non-operating expenses.

Total Debt Service: This value is the sum of all principal and interest payments required to service the borrower’s outstanding debts during a specified period.

A DSCR of 1.0 indicates that the borrower’s net operating income is equal to their total debt service, suggesting that the borrower is just able to meet their debt obligations. A DSCR greater than 1.0 signifies that the borrower has sufficient cash flow to cover their debts, while a ratio below 1.0 implies that the borrower may struggle to meet their obligations.

Significance of DSCR in Lending

Lenders rely on the DSCR to evaluate the financial stability of borrowers, particularly in commercial lending and real estate financing. The following are some of the key reasons why DSCR is important in the lending process:

Risk Assessment:

The DSCR provides lenders with a quantitative measure of a borrower’s ability to repay their debts, helping them assess the level of risk associated with a loan. Higher DSCRs generally indicate lower risk, while lower DSCRs suggest higher risk.

Loan Approval:

Lenders use the DSCR as a benchmark for loan approval. They typically require a minimum DSCR, such as 1.25 or 1.5, to ensure that borrowers have a financial cushion to service their debts in the event of unforeseen circumstances or economic downturns.

Loan Terms:

The DSCR can also influence loan terms, such as interest rates and repayment schedules. Borrowers with higher DSCRs may qualify for more favorable terms due to their lower risk profiles.

Covenants:

Lenders often include financial covenants in loan agreements that require borrowers to maintain a minimum DSCR throughout the loan term. Failure to comply with these covenants can trigger penalties or default provisions, protecting the lender’s interests.

What is A Dscr Loan? : Youtube Videos We have found out for you

Summary: What is A Dscr Loan?

In summary, We asked The question : What is Dscr Loan? A DSCR loan is a financial product that provides financing based on a company’s cash flow rather than its assets or credit score. It can be an attractive option for small and medium-sized businesses that need financing but may not have significant assets or a long credit history. However, borrowers should carefully consider the advantages and disadvantages of DSCR loans before applying to ensure that it is the right fit for their business needs.